Custom Private Equity Asset Managers Can Be Fun For Everyone

Wiki Article

The Only Guide to Custom Private Equity Asset Managers

(PE): spending in companies that are not publicly traded. Approximately $11 (http://dugoutmugs01.unblog.fr/?p=3148). There may be a couple of points you don't comprehend regarding the sector.

Personal equity firms have an array of investment choices.

Since the most effective gravitate toward the larger bargains, the center market is a dramatically underserved market. There are extra vendors than there are highly experienced and well-positioned financing experts with considerable customer networks and sources to take care of a bargain. The returns of personal equity are commonly seen after a couple of years.

Not known Details About Custom Private Equity Asset Managers

Flying listed below the radar of large multinational companies, many of these little companies commonly give higher-quality customer solution and/or specific niche product or services that are not being supplied by the huge empires her explanation (https://filesharingtalk.com/members/589221-cpequityamtx). Such benefits bring in the rate of interest of private equity companies, as they possess the insights and savvy to make use of such opportunities and take the firm to the following level

Private equity investors need to have dependable, qualified, and reliable monitoring in area. The majority of managers at profile companies are provided equity and reward settlement frameworks that compensate them for hitting their financial targets. Such placement of objectives is normally called for prior to a bargain gets done. Personal equity opportunities are frequently unreachable for people that can't invest countless dollars, yet they should not be.

There are regulations, such as restrictions on the accumulation quantity of money and on the number of non-accredited investors (Syndicated Private Equity Opportunities).

The Facts About Custom Private Equity Asset Managers Uncovered

One more disadvantage is the lack of liquidity; as soon as in an exclusive equity deal, it is difficult to obtain out of or market. There is a lack of flexibility. Exclusive equity likewise features high costs. With funds under administration already in the trillions, exclusive equity firms have actually come to be attractive financial investment lorries for rich individuals and organizations.

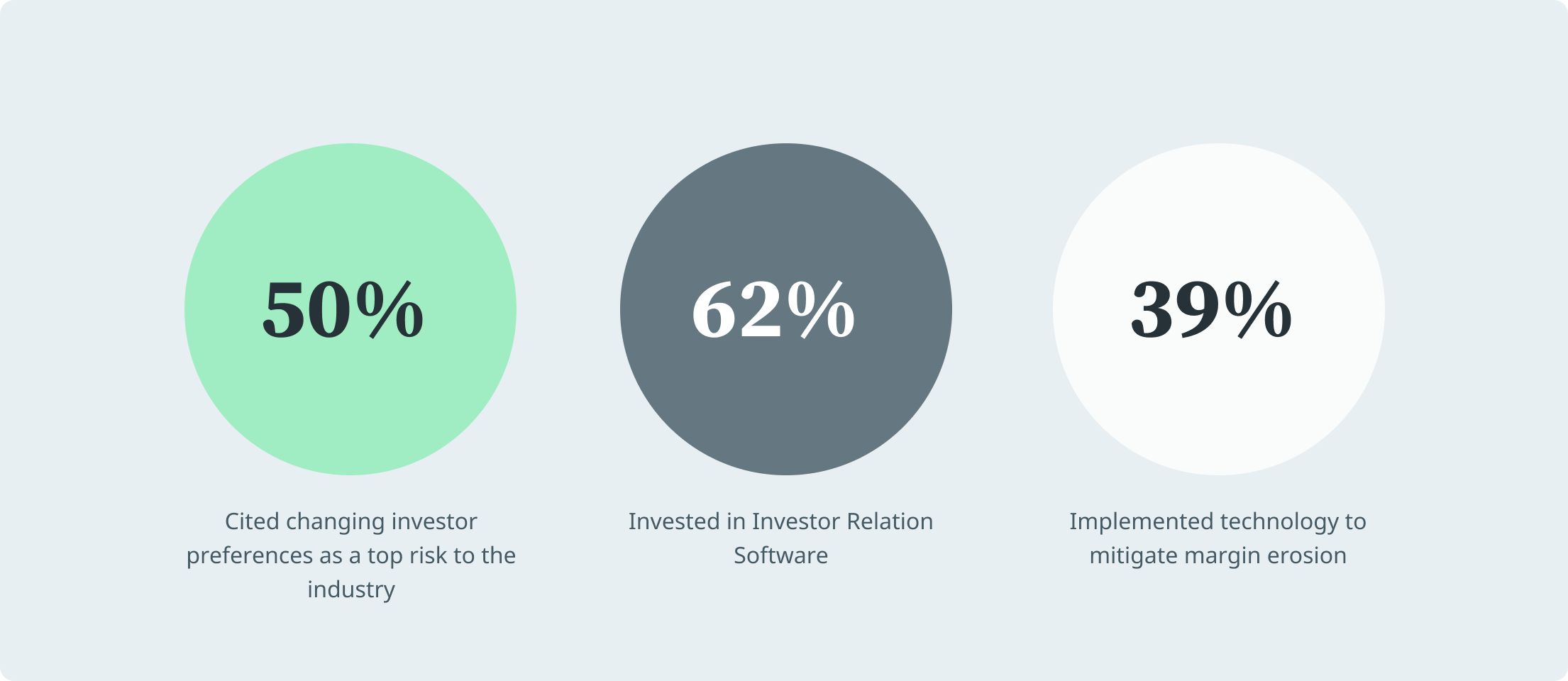

Currently that accessibility to exclusive equity is opening up to even more specific investors, the untapped potential is becoming a reality. We'll start with the primary disagreements for spending in private equity: Exactly how and why personal equity returns have actually historically been higher than other properties on a number of degrees, Exactly how consisting of private equity in a portfolio influences the risk-return account, by aiding to branch out versus market and cyclical risk, Then, we will outline some crucial factors to consider and dangers for personal equity capitalists.

When it pertains to introducing a new asset right into a portfolio, the many standard factor to consider is the risk-return profile of that property. Historically, personal equity has actually displayed returns comparable to that of Emerging Market Equities and greater than all various other traditional property courses. Its relatively reduced volatility paired with its high returns produces a compelling risk-return account.

The Best Strategy To Use For Custom Private Equity Asset Managers

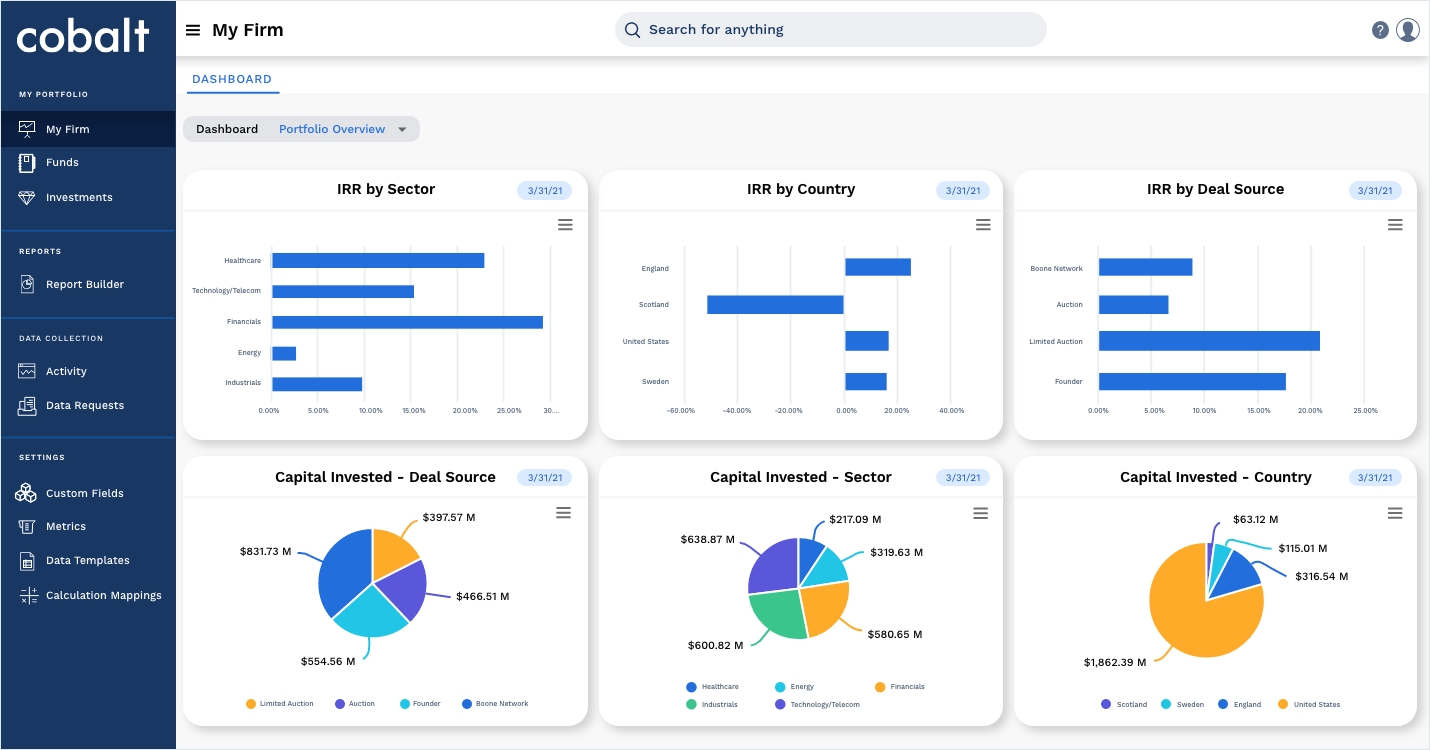

In fact, exclusive equity fund quartiles have the largest variety of returns across all alternative possession classes - as you can see below. Method: Interior rate of return (IRR) spreads calculated for funds within vintage years individually and afterwards averaged out. Mean IRR was determined bytaking the standard of the average IRR for funds within each vintage year.

The takeaway is that fund selection is crucial. At Moonfare, we execute a strict option and due persistance process for all funds detailed on the platform. The effect of adding exclusive equity right into a profile is - as constantly - reliant on the profile itself. A Pantheon research study from 2015 recommended that including exclusive equity in a portfolio of pure public equity can open 3.

On the various other hand, the most effective personal equity companies have access to an even bigger swimming pool of unidentified chances that do not encounter the same analysis, as well as the resources to do due persistance on them and determine which are worth spending in (Asset Management Group in Texas). Investing at the ground flooring suggests higher risk, however, for the firms that do prosper, the fund take advantage of higher returns

7 Simple Techniques For Custom Private Equity Asset Managers

Both public and private equity fund managers commit to investing a percentage of the fund however there remains a well-trodden issue with straightening passions for public equity fund management: the 'principal-agent problem'. When a financier (the 'primary') works with a public fund manager to take control of their capital (as an 'agent') they entrust control to the supervisor while retaining ownership of the assets.

When it comes to private equity, the General Companion does not simply earn an administration charge. They likewise earn a percent of the fund's revenues in the kind of "carry" (usually 20%). This guarantees that the interests of the supervisor are straightened with those of the capitalists. Exclusive equity funds likewise mitigate another kind of principal-agent trouble.

A public equity investor inevitably wants one thing - for the management to raise the supply price and/or pay returns. The investor has little to no control over the choice. We showed over the amount of personal equity approaches - particularly majority acquistions - take control of the running of the company, guaranteeing that the long-term worth of the business comes first, rising the return on investment over the life of the fund.

Report this wiki page